A more efficient way to express a negative view of the markets

What are Inverse ETFs?

Inverse ETFs are investments that seek to deliver the opposite performance of their reference index on a daily basis, before fees and expenses. Global X Investments Canada Inc. offers inverse ETFs based on two of the most widely followed market indices in Canada and the United States:

Who Uses Inverse ETFs?

Ideal for investors seeking to profit or protect during market declines or periods of increased volatility, and who are comfortable with a high degree of risk.

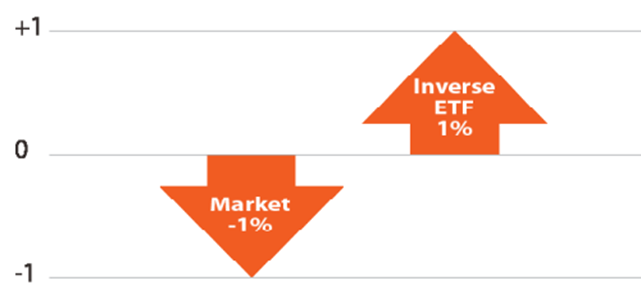

How an Inverse ETF Works

Inverse ETFs are similar to holding short positions to hedge against, or profit from, falling prices.

The Inverse ETF strives to return the opposite of its reference index* on a daily basis.

*Before fees and expenses.

Example: An investor who owns a broadly diversified portfolio of Canadian large-cap stocks believes that the Canadian large-cap market will decline over the next quarter. The investor could hedge their portfolio against a decline by buying the BetaPro S&P/TSX 60™ Daily Inverse ETF to hedge against it. By buying an inverse ETF, the investor can avoid selling stocks from their existing portfolio, which may incur a capital gain/loss, while continuing to benefit from the dividends paid by those stocks.

Key Benefits of Inverse ETFs

- No margin account required (no borrow/margin calls to worry about)

- Eligible for non-margin accounts such as RRSPs, RESPs and TFSAs

- Risk is limited to the capital invested (short selling, on the other hand, is subject to potentially unlimited loss)

- Can reduce risk without having to sell existing stocks and incur a capital gain/loss

- Allows investors to continue receiving any dividends paid by the stocks they are hedging in their portfolio

BetaPro S&P/TSX 60™ Daily Inverse ETF (HIX)

The BetaPro S&P/TSX 60™ Daily Inverse ETF seeks daily investment results, before fees, expenses, distributions, brokerage commissions and other transaction costs, that endeavour to correspond to one time (100%) the inverse (opposite) of the daily performance of the S&P/TSX 60™ Index.

BetaPro S&P 500® Daily Inverse ETF (HIU)

The BetaPro S&P 500® Daily Inverse ETF seeks daily investment results, before fees, expenses, distributions, brokerage commissions and other transaction costs, that endeavour to correspond to one time (100%) the inverse (opposite) of the daily performance of the S&P 500®. Any U.S. dollar gains or losses as a result of the ETF’s investment will be hedged back to the Canadian dollar to the best of its ability.

These ETFs are highly speculative. They are intended for use in daily or short-term trading strategies by sophisticated investors. If you hold these ETFs for more than one day, your return could vary considerably from the ETFs’ daily target return. Any losses may be compounded. These ETFs are not for investors who are looking for a longer-term investment.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X money market funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

The Alternative ETFs are alternative mutual funds within the meaning of the National Instrument 81-102 Investment Funds (“NI 81-102”), and are permitted to use strategies generally prohibited by conventional mutual funds, such as the ability to invest more than 10% of their net asset value in securities of a single issuer, the ability to borrow cash, to short sell beyond the limits prescribed for conventional mutual funds and to employ leverage of up to 300% of net asset value. While these strategies will only be used in accordance with the investment objectives and strategies of the Alternative ETFs, during certain market conditions they may accelerate the risk that an investment in ETF Shares of such Alternative ETF decreases in value. The Alternative ETFs will comply with all requirements of NI 81-102, as such requirements may be modified by exemptive relief obtained on behalf of the ETF.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

“Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and “TSX®” is a registered trademark of the TSX Inc. (“TSX”). These marks have been licensed for use by Global X Investments Canada Inc. The ETF is not sponsored, endorsed, sold, or promoted by the S&P, TSX, or their affiliated companies and none of these parties make any representation, warranty, or condition regarding the advisability of buying, selling or holding units/shares of the ETF.

Published May 1, 2024