The AI Revolution takes hold

What’s been dominating financial market headlines as of late is the massive rally in share prices by semiconductor companies, led by NVIDIA Corporation (NASDAQ: NVDA) — which was up more than 25% in after-hours trading on May 24, 2023 – nearing the coveted trillion-dollar market cap mark.

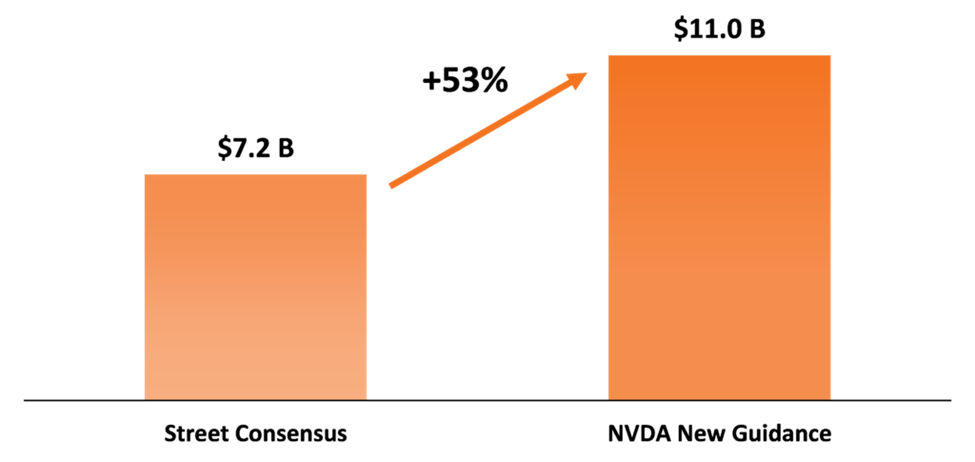

This came on the heels of NVIDIA’s jaw-dropping guidance revision, which pointed towards $11 billion of revenue in the second quarter alone (vs. $7 billion from prior market (or analyst) consensus).

NVDA’s Second-quarter Revenue Expectations vs. Prior Street Consensus

What supported this guidance uplift is the expectation for generative AI to unlock an enormous expansion of demand for computing requirements.

Many people have heard of ChatGPT by now, a chatbot that can generate responses in the form of human conversation. ChatGPT is an example of generative AI, however, there could be a mind-boggling amount of other use cases for generative AI across media, technology, industrial, and many other sectors.

The bulk of the demand surge is coming from data center infrastructure products, which will transition from “general purpose” to “accelerated computing” as companies across the spectrum of the economy look to apply generative AI to every product, service, and/or business process.

Data, data, and more data

The revolution can be boiled down to one word: data. Massive amounts of data are required to be processed through data centers, which house vast computing resources and storage, enabling AI to complete complex calculations and support AI applications.

The bottom line is that the winners of the AI revolution will be the companies that can meet the demand for high-processing-powered data centers.

Broadly speaking, semiconductor manufacturing companies should benefit from this ongoing trend. Not only will a greater demand for semiconductors be needed to meet the increasing computing, memory, and networking requirements of the AI revolution—but the underlying generative AI technology can help the chip companies run more efficiently, develop new products, enter new markets, and ultimately spark greater innovation.

How to pick the winning horse?

Globally, chipmakers are set to benefit by varying degrees depending on their product mix exposures. Investing in the winners becomes a difficult task when mixing in the geopolitical tensions between the U.S. and China, which could block out markets for certain companies depending on where they are based. U.S. companies like NVIDIA could lose access to the Chinese market and vice-versa.

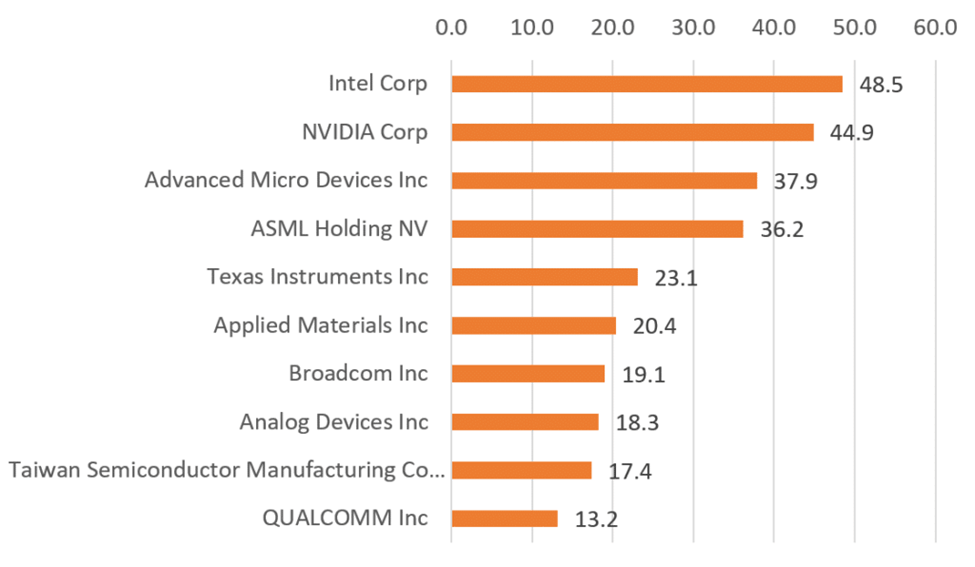

Making it even more difficult to invest in the semiconductor sector is the broad range of valuations across the space, which infers a variety of investor opinions on the quality and growth prospects of publicly traded semiconductor companies. We can observe an extreme dispersion in the price-to-earnings ratio (P/E) multiples within chipmakers:

Forward P/E Multiples of Semiconductor Stocks (as of May 26, 2023)

For those looking to gain exposure to the space without picking up the idiosyncratic risk that comes with individual stock selection—an ETF can be a more-than-ideal way to gain exposure to the AI revolution. There is an abundance of expected growth that potentially equates to a rising tide that “lifts all boats” within the space, which could benefit a broad ETF.

Global X Semiconductor Index ETF (CHPS) (formerly Horizons Global Semiconductor Index ETF) tracks the Solactive Capped Global Semiconductor Index, holding more than 50 global semiconductor companies at 0.55% management expense ratio as at December 31, 2022.

The top ten holdings of CHPS as at May 26, 2023, are as follows:

- NVIDIA Corp

- Broadcom Inc

- Taiwan Semiconductor Manufacturing Co Ltd – ADR

- ASML Holding NV

- Advanced Micro Devices Inc

- Texas Instruments Inc

- Qualcomm Inc

- Intel Corp

- Applied Materials Inc

- Analog Devices Inc

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

The financial instrument is not sponsored, promoted, sold, or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade name or the Index Price at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade name for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in this financial instrument.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published June 2, 2023

Categories: Articles, Insights

Topics: A.I., Semiconductors, Technology