The first quarter of 2024 saw a wide range of market-moving events that gave insights into the state of play of the economy and its various moving parts. In this blog, Global X takes a look at the performance of key asset classes and the news that drove markets over the period.

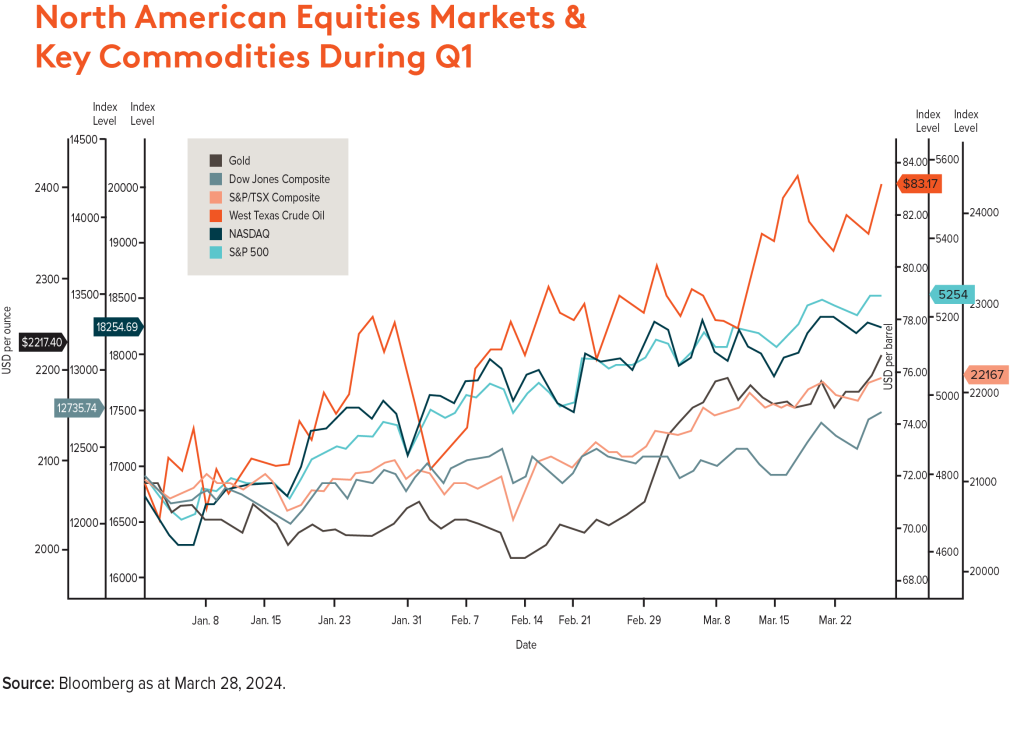

At a glance, here’s how North America’s leading equity markets and key commodities fared over the first three months of the year:

JANUARY

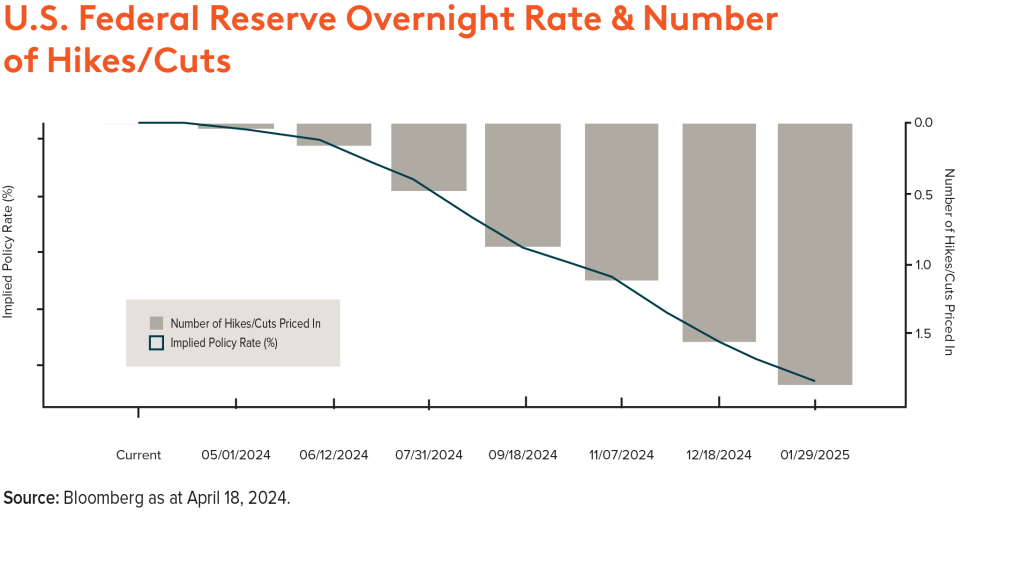

The Bank of Canada (BoC) kept its overnight rate at 5% for the fourth meeting in a row, amid persistent inflation and an economy that has yet to slow down enough for the start of rate cuts. The U.S. Federal Reserve (Fed), meanwhile, left its rate unchanged at 5.25% to 5.5% – the fourth time in a row that rates have stayed unchanged, delaying rate cuts that the market had previously been anticipating.

The yield on 10-year government bonds in the U.S. fell 19.7 basis points (bps) during January, its best performance since October 2023.

In equities, the TSX Composite Index ended January up 0.3%. During a month in which it registered new record highs, the Dow Jones Industrial Average® and the S&P 500® ended January up 1.2% and 1.6% respectively, while the NASDAQ® rose by 1% during January.

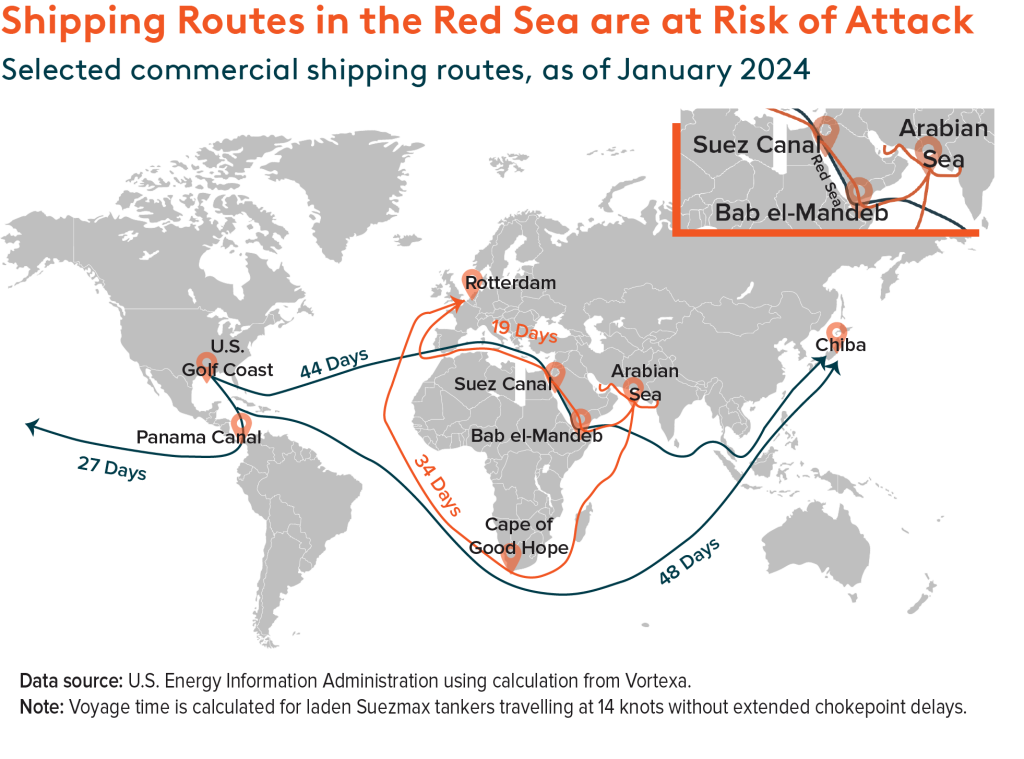

In Commodities, spot gold was down 1.3% over January, while oil rose 6% during a month that saw attacks on vessels in the Red Sea region, prompting concerns over shipping, safety and stability in the Middle East. Global X gave an update on the near-term outlook for oil here.

Official data from China, meanwhile, showed that the economy grew by 5.2% in 2023. The data was higher than official targets but showed that the nation’s post-COVID recovery was not going as smoothly as market participants were expecting.

FEBRUARY

Canada added just over 37,000 jobs in January 2024 while inflation as measured by the Consumer Price Index (CPI) slowed to 2.9% year-over-year – that was less than economist expectations of a rise of 3.3%.

The TSX Composite ended February up 1.6%2 while south of the border, the NASDAQ® rose by 4.7%2 in February – its first record close in two years – as chipmaker NVIDIA briefly hit a market capitalization of US$2 trillion, becoming the fourth U.S. company to hit this market milestone after Apple, Microsoft and Amazon. The company’s fiscal fourth-quarter earnings beat market expectations with year-over-year (YOY) revenue growth of 265% with its data center business registering YOY growth of 409%.

The U.S. employment market started the year on a strong note as nonfarm payrolls rose by 353,000 in January and the unemployment rate remained at 3.7%. Inflation rose 0.3% in January due to housing costs but on a 12-month basis, fell to 3.1%. The Personal Consumption Expenditures Index – another inflation indicator – rose 0.4%.

In Commodities, spot gold was down 0.7% over the month, while oil rose over 3% as benchmark West Texas Intermediate has traded in a narrow range in recent months with some forecasters seeing lacklustre demand amid a slowing supply picture.

The yield on 10-year U.S. government bonds ended the month up 38 bps at 4.25% as the most recent minutes from the January meeting of the U.S. Federal Reserve’s rate-setting committee seemed to indicate a cut in rates in the summer.

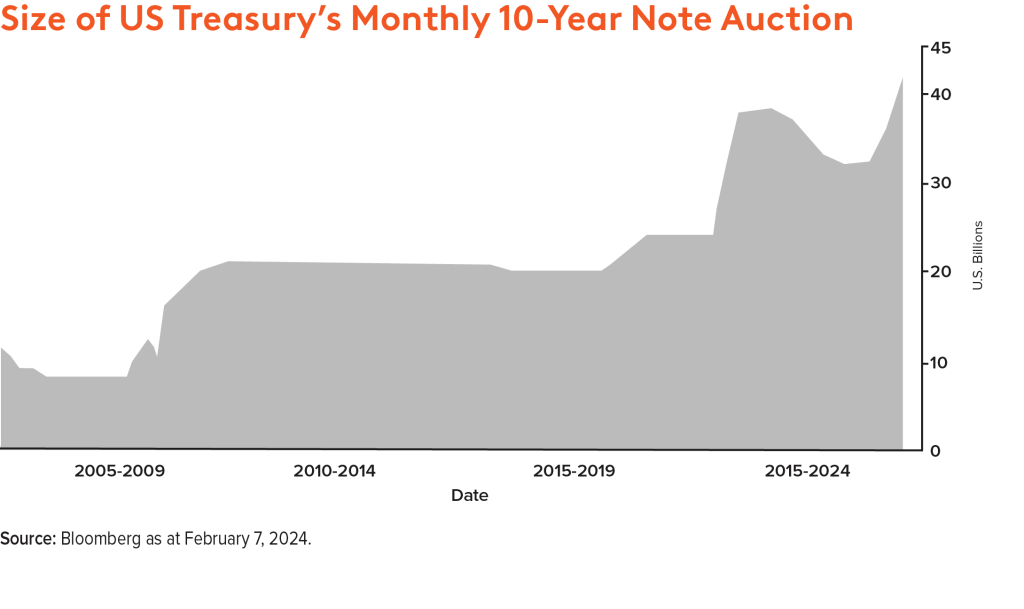

The U.S. Treasury sold a record US$42 billion of 10-year treasury notes during the month, part of the US$760 billion it said it would raise from the market.

MARCH

The TSX ended March up 3.8%, setting a new record high with financial and real estate stocks leading the rally as investors welcomed recent signs that inflation was cooling. In a speech, BoC’s Deputy Governor Toni Gravelle said due to the “progress we have made on inflation” its policy discussions have shifted from what needs to be done to cool inflation to how much longer monetary policy needs to stay at its current level.

However, the BoC kept rates on hold for the fifth consecutive time in early March, commenting that its rate-setting Governing Council still wants to see “further and sustained easing in core inflation”.

In the United States, the NASDAQ® rose by 1.79% while the Dow Jones Industrial Average® and the S&P 500® ended the month up 2.08% and 3.1% respectively.

In the Commodities space, gold has climbed over 9% so far in 2024, while West Texas Intermediate Crude was up 17.8% for the year to date amid tighter oil supplies and increased demand. March pushed West Texas Intermediate crude above US$80 a barrel this month as pressure was added to fuel markets with drone strikes on Russian oil facilities. Both OPEC’s largest and second-largest oil producers released news of slowing exports.

Copper hit a new high during March as investors focused on supply risks such as Chinese copper smelters – who handle about half of the world’s copper – agreeing to cut production, a move set to curtail copper processing capacity globally. Global X wrote about the supply and demand dynamics powering copper and lithium here.

The yield on 10-year U.S. government bonds traded around 4.2%, up from 3.86% where it was trading at the end of last year. You can read here why investors should consider U.S. treasuries in their portfolios.

On the economic front, investors received three data points that shed further insight into Canada’s economy. Gross Domestic Product for February showed the economy likely grew by 0.4% while inflation – as measured by the CPI – cooled in February from the prior month’s 2.9% gain on a 12-month basis. Canadian retail sales fell by 0.3% in January, which was lower than estimates.

The U.S. added 275,000 jobs in February and single-family housing starts (which accounts for the bulk of homebuilding) were 11.6% higher than a year earlier, February CPI came in higher than expected at 3.2% on a YOY basis with core inflation at 3.8% – higher than the Fed’s 2% target. The Fed’s preferred inflation gauge – Personal Consumption Expenditures (PCE) – was reported at 2.5% on an annualized basis, which was in line with expectations.

Rate Expectations

CPI readings play an important role in the way the Fed shapes interest rate decisions as it continues its goal to lower inflation to its 2% target. It needs to see more compelling evidence that inflation is nearing 2% before beginning rate cuts.

The market had been expecting rate cuts in Canada and the U.S. in the summer. But the newest comments from Fed Chair Jerome Powell indicate that investors may have to wait a little longer for rate cuts south of the border.

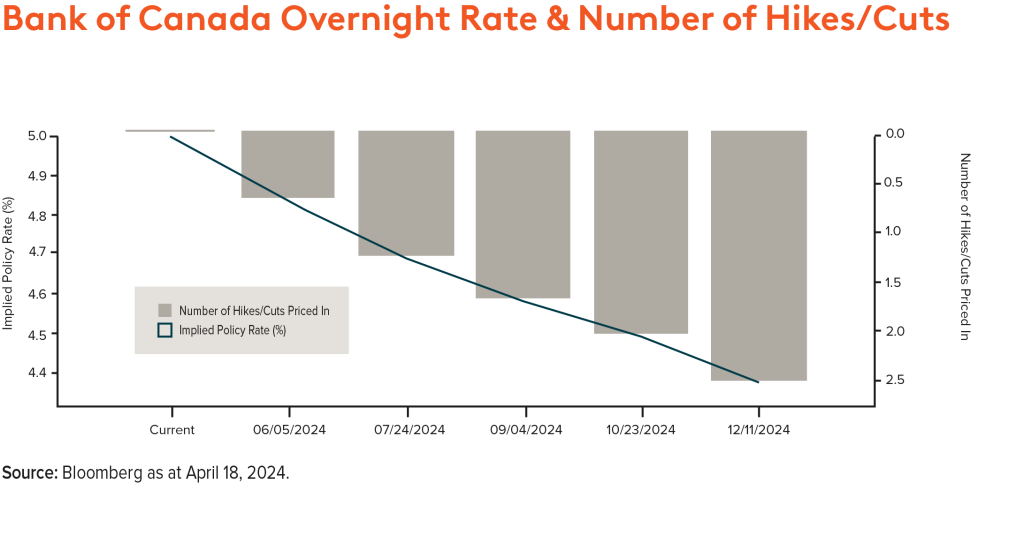

The following charts illustrate the probability of rate cuts by the Fed and BoC this year.

For investors looking to benefit from financial markets and how they may play out over various time horizons, Global X offers a wide suite of exchange-traded funds that cover different asset classes and investment themes. Find out more here.

Sources

1 Source: Bloomberg, January 31, 2024 (for TSX move in January)

2 Source Bloomberg as at February 29, 2024

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X Money Market Funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published May 27, 2024

Categories: Articles, Insights

Topics: Commodities, Gold, Oil