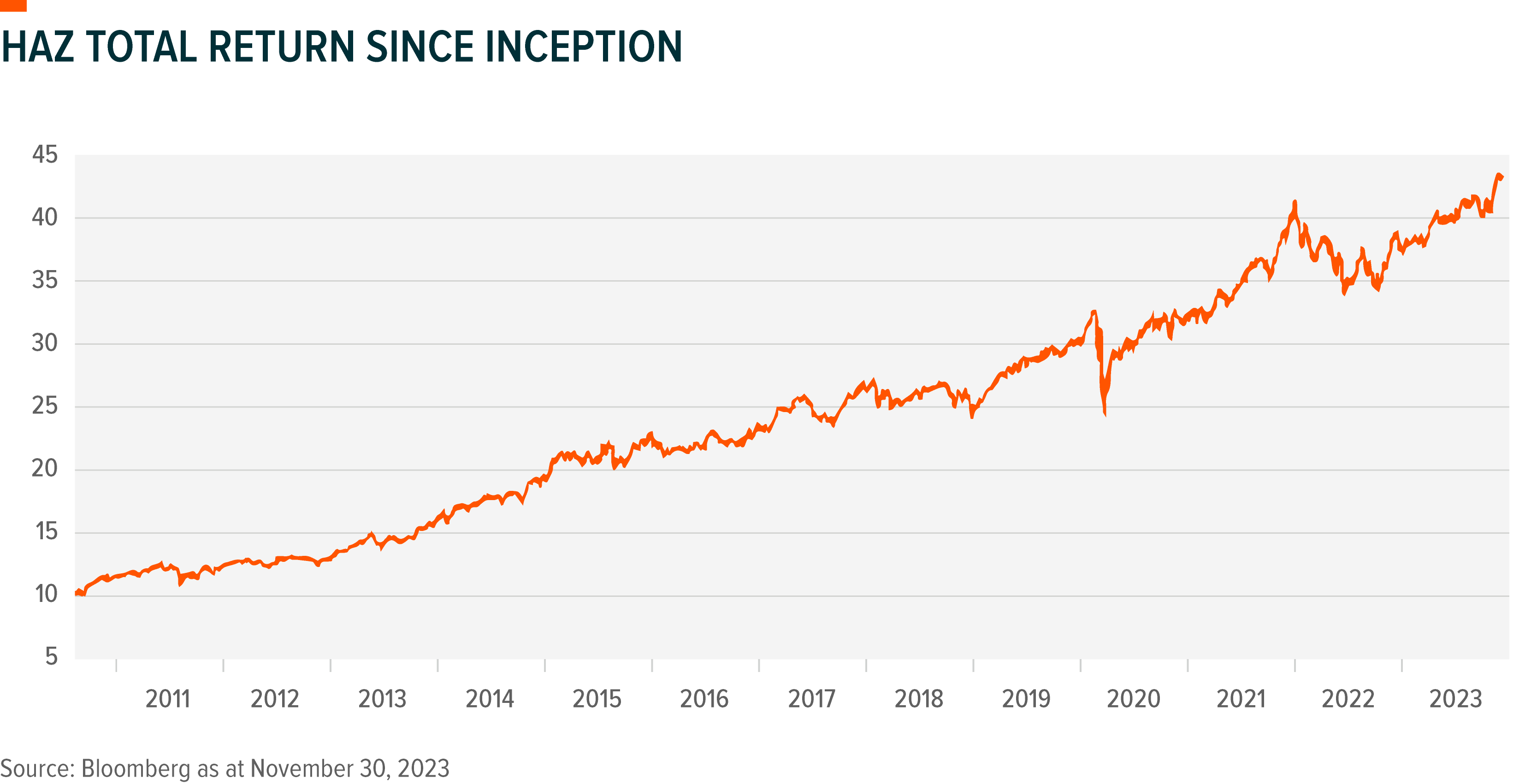

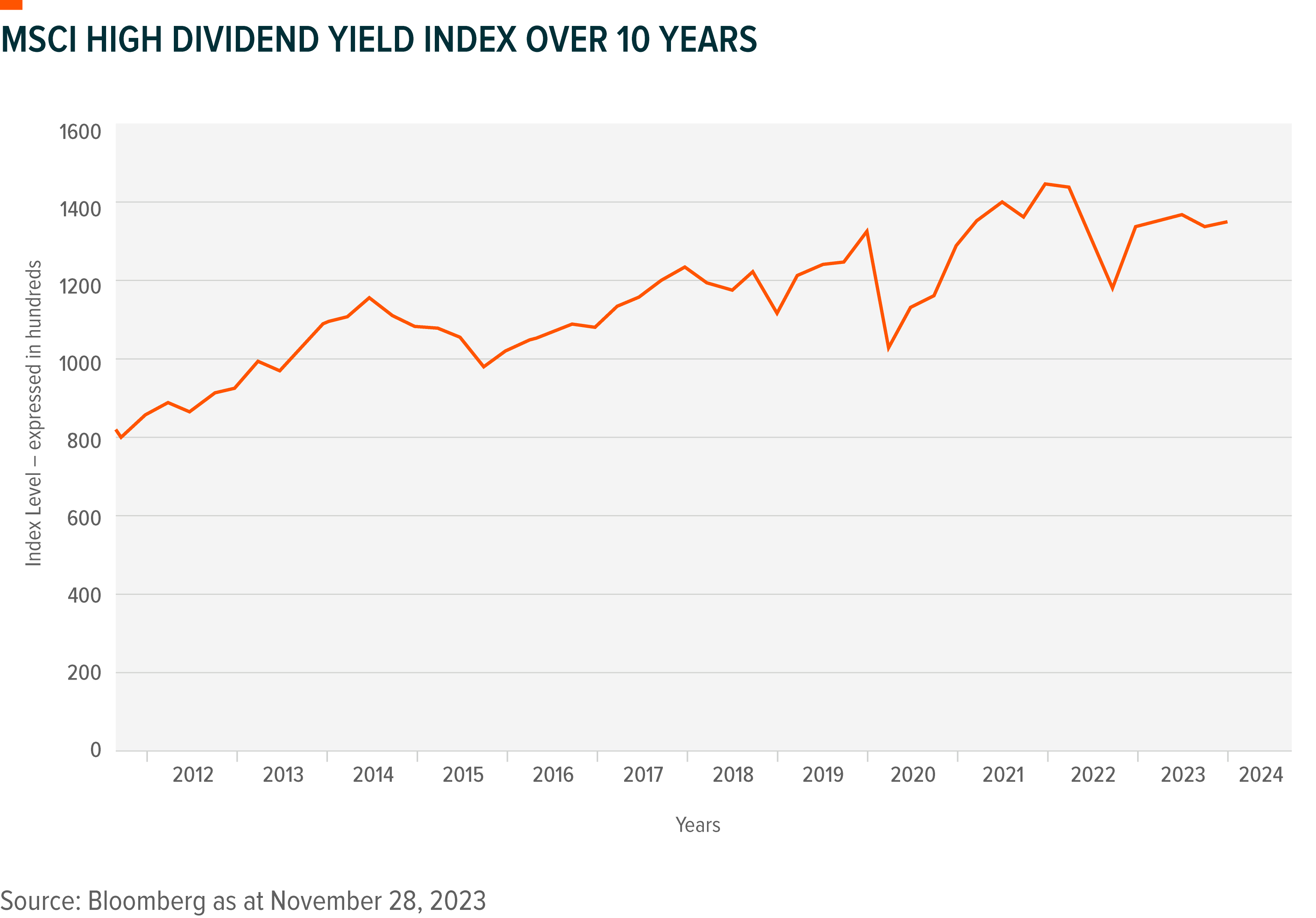

Investors know that dividends are one source of positive market returns. One ETF that looks to provide regular dividend income and modest long-term capital growth is the actively managed Global X Active Global Dividend ETF (“HAZ”) (formerly Horizons Active Global Dividend ETF). HAZ invests in some of the attractive dividend-paying stocks and has seen total return up 310% since inception.

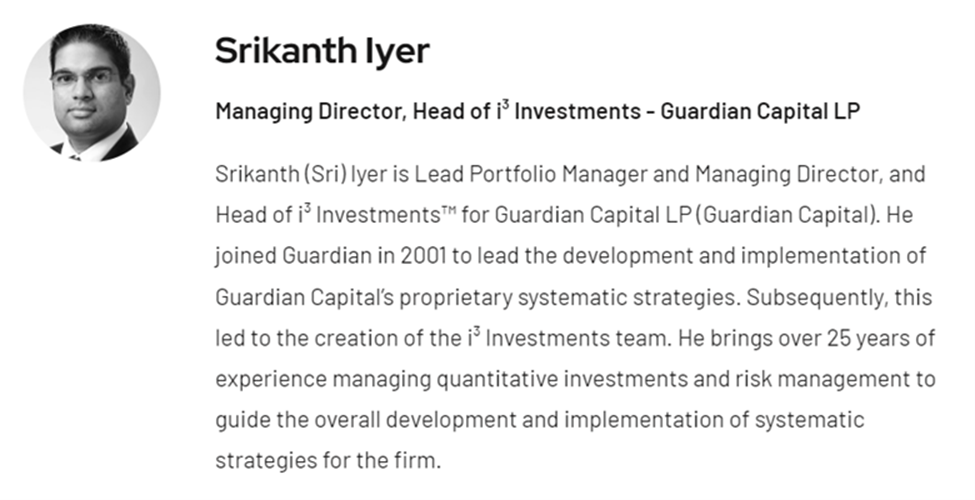

Guardian Capital LP (“Guardian Capital”) is the sub-advisor for HAZ. The firm’s i3 Investmentstm team – led by Srikanth Iyer – uses Artificial Intelligence (“AI”) to rigorously screen every stock in HAZ to determine the statistical probabilities of dividend growth, payout and sustainability.

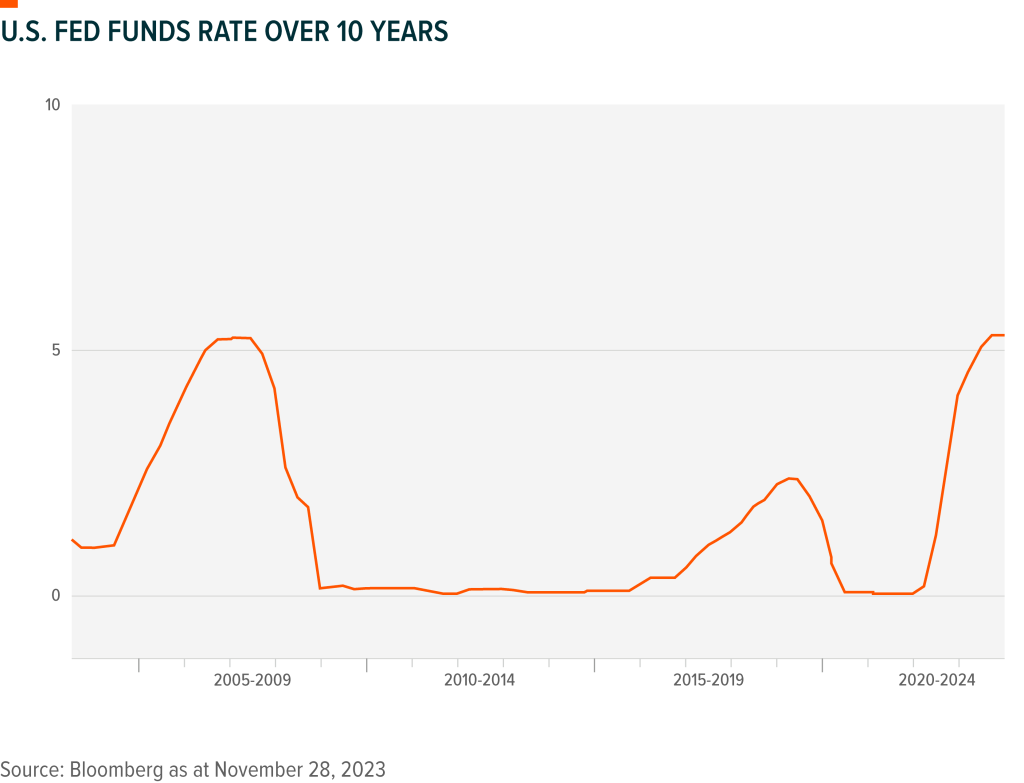

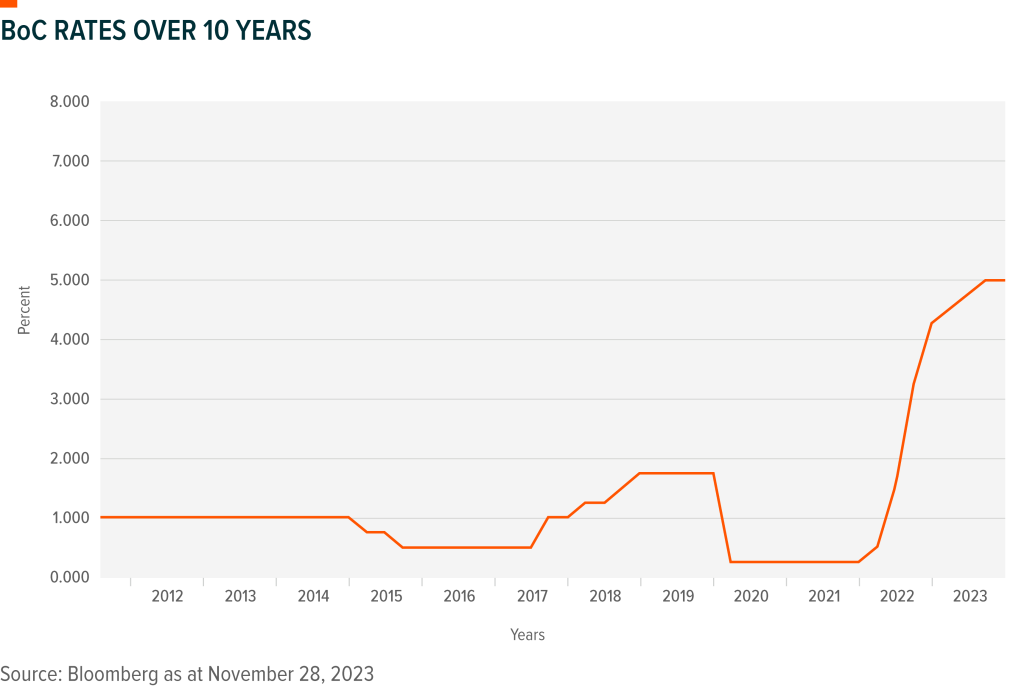

A NEW INTEREST RATE REALITY

From pandemic lows to current highs of around 5% in Canada and the U.S., rising interest rates have adversely impacted dividend stock investing.

A large number of those dividend-paying stocks are in the Consumer Defensive and Utilities sectors and are also known as bond proxies – equities that replicate the performance of bonds while offering higher levels of income. Amid high interest rates, bond proxy yields when compared to their corporate bond counterparts have fallen to their lowest levels in decades.

Along with higher interest rates come higher financing costs for companies in cash-intensive sectors such as Utilities. Part of HAZ’s recent strategy is that it isn’t holding bond proxies due to these limitations.

HAZ’s edge: dividend growth probability

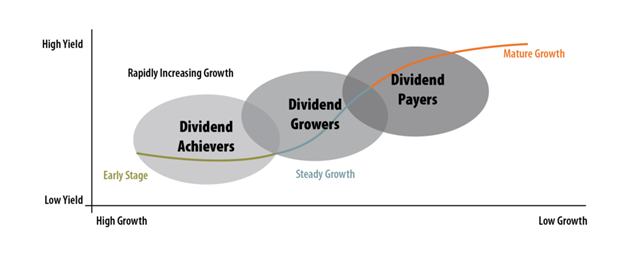

Dividend growth predictions are on the rise in late 2023 and into 2024.

Patterns identified by the i3 Investmentstm team’s AI model suggest the Information Technology, Consumer Discretionary and Energy sectors showing strong dividend growth forecasts.

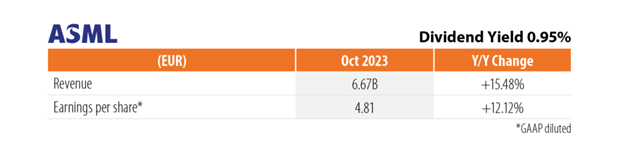

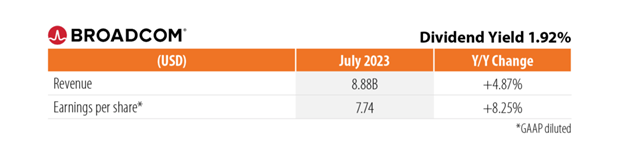

“When you begin factoring in this level of statistical probability on stocks in the portfolio, we believe it’s hard to lose on a relative basis versus other strategies over time,” says Guardian Capital LP’s Sri Iyer. Two names within HAZ – Broadcom and ASML – have returned 97% and 45% over the last year respectively (Source: Bloomberg from October 31, 2022 to November 30, 2023).

Broadcom Inc. (AVGO) is a global technology leader that designs, develops, and supplies semiconductor and infrastructure software solutions.

ASML is a leading supplier to the semiconductor industry. The company provides chipmakers with hardware, software and services to mass produce the patterns of integrated circuits (microchips).

Capital Appreciation

Active ETFs such as HAZ combine portfolio management with cost-effective fees to help generate better risk-adjusted returns. Global X Investments Canada Inc.’s (“Global X”) actively managed ETFs trade like stocks on an exchange, but with lower management fees than standard mutual funds, and provide the intra-day liquidity of an ETF.

HAZ is currently focused on modest capital appreciation as the strategy used by the i3 Investmentstm team currently estimates strong earnings growth across the global equity market in other areas – most notably technology – which is a sector that currently has attractive valuations. Generally, a company with high and sustainable earnings growth will eventually start to return more of that to investors as shareholder yield which results in dividend growth.

Employing a proprietary AI model to search for anticipated dividend growth is just one of the advantages of the actively managed Global X Active Global Dividend ETF (HAZ). To find out more visit www.globalX.ca/ETF/haz/.

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published December 14, 2023

Categories: Articles, Insights

Topics: Dividends, International