Gold recently hit a record high and it is up 10.43% YTD as at November 30, 2023. Bullion prices have since fallen back below US$2000/oz.

Key drivers supporting gold

- Heightened geopolitical tension and direct purchasing by central banks as an alternative reserve asset

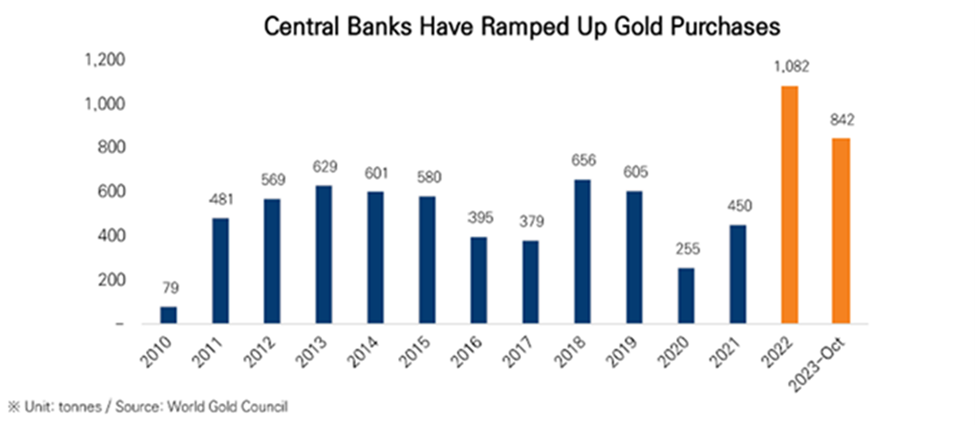

The graph below illustrates ramped-up purchasing activities by central banks as gold demand soared to an 11-year high in 2022.

- Economic uncertainty and falling rate expectations

- Weakening U.S. Dollar

- Seasonality – strong through December and January with some potential to extend into February.

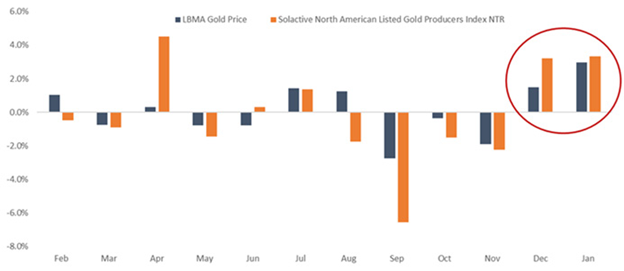

The graph below illustrates based on the period from December 31, 2012, to December 31, 2022, gold and gold producers exhibit strong seasonality in December and January, as represented by the Solactive North American Listed Gold Producers Index (underlying of GLCC) and LBMA Gold Price. In particular, Gold producers generally have returns in the same direction but are typically more amplified in both directions.

Competitor Overview and Ways to Invest in Gold

Exposure to gold can be achieved by investing in physical gold, directly or indirectly, or by investing in Gold equities. Gold producers may outperform Gold bullion in gold bull market cycles due to operating leverage due to their fixed cost base. If elevated gold prices persist, investors can participate in growth potential resulting from higher revenues due to elevated production at higher prices. Covered Call strategies have been popular in 2023, and GLCC, the Global X Gold Producer Equity Covered Call ETF (formerly Horizons Gold Producer Equity Covered Call ETF) can be an effective way to get exposure to the largest and most liquid North American listed gold producers while also generating income through the use of a dynamic call writing approach.

For more risk-averse investors, HGY, the Global X Gold Yield ETF (formerly Horizons Gold Yield ETF) can be a strong candidate due to lower volatility and since it partially eliminates the opportunity cost of holding gold in a higher interest rate environment. Unlike other physical Gold ETFs, HGY pays an attractive monthly yield with the trade-off being less potential upside capture.

Below is an overview of the funds referenced above with their product features.

| Global X Gold Producer Equity Covered Call ETF | CI Gold+ Giants Covered Call ETF | iShares S&P/TSX Global Gold Index ETF | Global X Gold Yield ETF | iShares Gold Bullion ETF | |

|---|---|---|---|---|---|

| Ticker | GLCC | CGXF | XGD | HGY | CGL |

| Management Fee | 0.65% | 0.65% | 0.55% | 0.60% | 0.50% |

| Investment Objective | The Global X Gold Producer Equity Covered Call ETF (formerly Horizons Gold Producer Equity Covered Call ETF) seeks to provide, to the extent possible and net of expenses: (a) exposure to the performance of an index of equity securities of diversified North American listed gold producers (currently, the Solactive North American Listed Gold Producers Index) and (b) monthly distributions of dividend and call option income. To mitigate downside risk and generate income, GLCC will employ a dynamic covered call option writing program. | The ETF’s investment objective is to provide Unitholders, through an actively managed portfolio, with (i) quarterly cash distributions, (ii) the opportunity for capital appreciation by investing on an equal weight basis in a portfolio of equity securities of at least the 15 largest gold and precious metals companies measured by market capitalization listed on a North American stock exchange, and (iii) lower overall volatility of returns on the portfolio than would be experienced by owning a portfolio of securities of such issuers directly by employing a covered call option writing program. The issuers included in the portfolio, which is based on their market capitalization, may be adjusted based on the Portfolio Manager’s view on the liquidity of the issuer’s equity securities and their related call options. | The iShares S&P/TSX Global Gold Index ETF seeks to provide long-term capital growth by replicating the performance of the S&P/TSX Global Gold Index, net of expenses. | The Global X Gold Yield ETF (formerly Horizons Gold Yield ETF ) seeks to provide Unitholders with (i) exposure to the price of gold bullion hedged to the Canadian dollar, less HGY’s fees and expenses; (ii) tax-efficient monthly distributions; and (iii) in order to mitigate downside risk and generate income, exposure to a covered call option writing strategy. | The iShares Gold Bullion ETF seeks to replicate the performance of the price of gold bullion, less fees and expenses. |

| Underlying Portfolio | The Solactive North American Listed Gold Producers Index is a representation of securities that are active in the Gold Ore Mining Industry and listed in North America. | Active Investment Strategies: CGXF invests in a portfolio of equity securities of at least the 15 largest gold and precious metals companies measured by market capitalization listed on a North American stock exchange. “Gold and precious metals companies” are generally producers or companies predominantly involved in the mining, fabrication, processing, marketing or distribution of metals, including gold, silver, platinum group and palladium, and diamonds. | The S&P/TSX Global Gold Index is designed to provide an investable index of global gold securities. Eligible Securities are classified under the GICS® Code 15104030 which includes producers of gold and related products, including companies that mine or process gold and the South African finance houses which primarily invest in, but do not operate, gold mines. | SPDR® Gold Shares | Gold Bullion |

| Weighting Methodology | Weighted according to Share Class Market Capitalization. Then, a weight cap is applied for each INDEX COMPONENT by re-distributing any weight which is larger than 10.0% to the other INDEX COMPONENT proportionally in an iterative manner. | Equal Weight | Float-adjusted market cap-weighted | – | – |

| Top Holdings (with weights) | Gold Fields Ltd – ADR — 10.62% Agnico Eagle Mines Ltd — 9.99% Anglogold Ashanti Plc — 9.93% Barrick Gold Corp — 9.84% Newmont Corp — 9.3% Kinross Gold Corp — 9.08% Alamos Gold Inc Cl A — 7.19% Pan American Silver Corp — 7.15% Endeavour Mining PLC — 7.07% B2Gold Corp — 5.27% Harmony Gold Mining Co Ltd – ADR — 4.7% Eldorado Gold Corp — 3.32% SSR Mining Inc — 2.97% Equinox Gold Corp — 2.11% NovaGold Resources Inc — 1.73% | Gold Fields Ltd – ADR — 7.45% Kinross Gold Corp — 7.15% Alamos Gold Inc Cl A — 7.09% AngloGold Ashanti Ltd — 7.06% Endeavour Mining PLC — 7.03% B2Gold Corp — 6.95% Barrick Gold Corp — 6.78% Wheaton Precious Metals Corp — 6.75% Agnico Eagle Mines Ltd — 6.73% Newmont Corp — 6.54% Royal Gold Inc — 6.53% SSR Mining Inc — 6.45% Pan American Silver Corp — 6.14% Franco-Nevada Corp — 5.91% Sibanye Stillwater Ltd – ADR — 5.43% | Newmont — 20.02% Barrick Gold Corp — 13.35% Agnico Eagle Mines Ltd — 11.43% Wheaton Precious Metals Corp — 9.51% Franco Nevada Corp — 9.01% Gold Fields Adr Representing Ltd — 5.68% Anglogold Ashanti Plc — 3.43% Royal Gold Inc — 3.38% Kinross Gold Corp — 3.11% Alamos Gold Inc Class A — 2.46% Endeavour Mining — 1.86% B2Gold Corp — 1.81% Harmony Gold Mining Adr Representi — 1.41% Eldorado Gold Corp — 1.14% Osisko Gold Royalties Ltd — 1.13% | SPDR Gold MiniShares Trust ETF | Gold Bullion |

| Covered Call Strategy | Dynamic Percent-Written as at Oct 31, 2023: 24.45% | At-the-money call options, targeting approximately 25%. | – | Conservative covered call option writing strategy Percent-Written as at Oct 31, 2023: 33.11% | – |

| Distribution Frequency | Monthly | Quarterly | Semi-Annually | Monthly | – |

| Currency Hedging | No | Yes | No | Yes | Yes |

Source: Global X Investments Canada Inc. and respective fund issuer website, as at December 5, 2023

Snapshot

| Ticker | Morningstar Category | Fund Size | Management Fee | MER | 12 Month Yield | Current Yield at NAV % | |

|---|---|---|---|---|---|---|---|

| Global X Gold Yield ETF Comm (formerly Horizons Gold Yield ETF) | HGY | Canada Fund Commodity | 61,997,247.00 | 0.60 | 0.90 | 6.16 | 6.14 |

| iShares Gold Bullion ETF (CAD-Hedge) | CGL | Canada Fund Commodity | 715,158,764.00 | 0.50 | 0.55 | 0.00 | – |

| LBMA Gold Price PM USD | – | – | – | – | – | – | – |

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Effective June 24, 2022, the investment objectives of the Global X Gold Producer Equity Covered Call ETF (“GLCC”) (formerly Horizons Equal Weight Canadian Bank Covered Call ETF), were changed following receipt of the required unitholder and regulatory approvals, to seek to provide exposure to the performance of an index of equal-weighted equity securities of diversified North American listed gold producers (currently, the Solactive North American Listed Gold Producers Index) and to employ a dynamic covered call option writing program. Previously, the ETF sought exposure to an underlying equal-weight equity portfolio and generally wrote covered call options on 100% of portfolio securities. The new ticker began trading on the TSX on June 27, 2022. For more information, please refer to the disclosure documents of the ETFs on globalx.ca.

The payment of distributions, if any, is not guaranteed and may fluctuate at any time. The payment of distributions should not be confused with an Exchange Traded Fund’s (“ETF”) performance, rate of return, or yield. If distributions paid by the ETF are greater than the performance of the ETF, distributions paid may include a return of capital and an investor’s original investment will decrease. A return of capital is not taxable to the investor, but will generally reduce the adjusted cost base of the securities held for tax purposes. Distributions are paid as a result of capital gains realized by an ETF, and income and dividends earned by an ETF are taxable to the investor in the year they are paid. The investor’s adjusted cost base will be reduced by the amount of any returns of capital. If the investor’s adjusted cost base goes below zero, investors will realize capital gains equal to the amount below zero. Future distribution dates may be amended at any time. To recognize that these distributions have been allocated to investors for tax purposes the amounts of these distributions should be added to the adjusted cost base of the units held. The characterization of distributions, if any, for tax purposes, (such as dividends/other income/capital gains, etc.) will not be known for certain until after the ETF’s tax year-end. Therefore, investors will be informed of the tax characterization after year-end and not with each distribution if any. For tax purposes, these amounts will be reported annually by brokers on official tax statements. Please refer to the applicable ETF distribution policy in the prospectus for more information.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

© [2023] Morningstar Research Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published December 22, 2023

Categories: Articles, Insights

Topics: Commodities, Gold