By Global X Research Team

Copper has long been associated with cyclical and macroeconomic trends, with demand for the metal and, subsequently, prices, being highly correlated with global economic growth.1 However, the world is changing and so too are copper’s supply and demand dynamics. Although cyclical trends and global economic growth will probably always play a large role in copper demand, the energy transition, mass electrification, urbanization, and the rise of Artificial Intelligence (AI), along with the requisite energy infrastructure investments that come with them, appear to be long-term, structural drivers of demand. This could result in an ongoing situation where supply struggles to meet demand, creating opportunities for miners.

Key Takeaways

- The increasing need for energy and subsequent grid buildouts from megatrends such as electrification, urbanization, and artificial intelligence present a potentially powerful tailwind for copper demand and could reduce the metal’s cyclicality over time.

- Global copper supply appears unlikely to meet the accelerating demand outlook, potentially resulting in higher prices over the medium to long term.

- The rebound in global industrial and manufacturing activity could provide a meaningful boost to copper demand in the short term.

Copper Demand Appears Set to Become More Structural

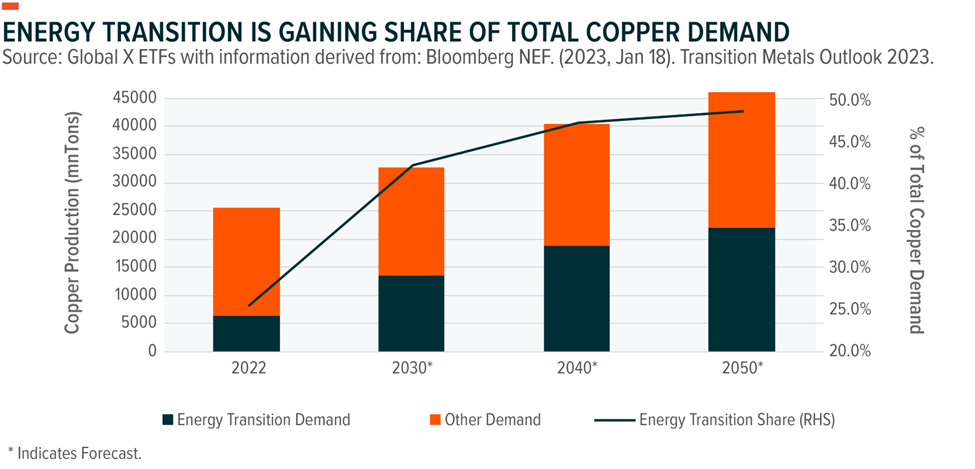

Copper’s role in the world is changing, with the industrial metal likely to be a key enabler of energy transition. Traditionally, copper’s main uses have been tied to construction, transportation, and machinery, making demand historically very correlated with the global economic cycle. China, and specifically its property sector, has traditionally been a large consumer of copper, being a driver of the “super cycle” witnessed at the start of this century. However, we believe the future demand outlook for copper will be increasingly different from the past. New trends such as electrification, urbanization, AI, and the subsequent grid buildout and power generation investments that these technologies will likely require, could increasingly become a larger share of the overall demand picture. Outsized demand growth outside of China is also expected moving forward, likely offsetting any potential further weakness in copper demand from that nation’s property sector. We do recognize that a large percentage of demand will likely remain cyclical, but this structural shift could result in reduced demand volatility, especially during times of slower economic growth.

Does the World Have Enough Copper to Meet Demand?

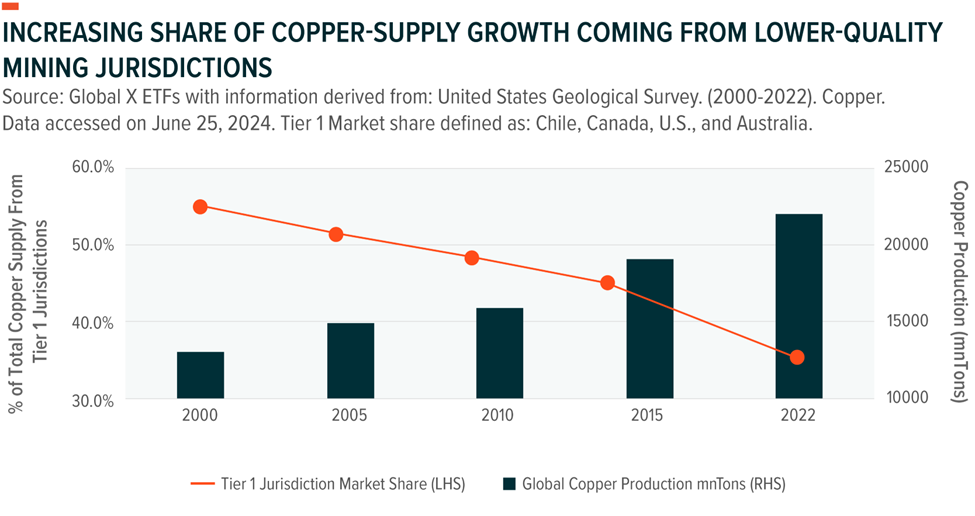

Given copper’s robust demand outlook, we believe it is fair to assume a supply-side response. Be it from substitution, increased scrap utilization, or investments in new projects, rising demand will likely push prices higher and increase investment in the sector. However, we do not see these supply responses meeting the robust demand outlook over the medium to longer term. The main reason is the declining economics around investing in new projects. Many of the most attractive projects, be it from a country risk, ore quality, or cost perspective, have either been or are in the process of being developed. As a result, this lack of new, quality assets forced miners to look at less attractive projects or to less favorable mining jurisdictions, with the share of global production from the four highest quality jurisdictions (Chile, Canada, the United States, and Australia) falling over the past 22 years through to 2022.2 Going into lower quality jurisdictions often comes with increased political and regulatory risks, higher capital intensity due to the lack of infrastructure, and increased risks of social unrest. Furthermore, rising inflationary pressures during the COVID-19 pandemic and its aftermath not only lowered margin expectations but also greatly increased up-front capital expenditures.3 This increase in upfront costs, along with the higher cost of capital globally, significantly lowered return expectations when evaluating a new project. As a result, we expect copper miners to require a higher long-term incentive price when evaluating new projects, weighing on the supply response and adding to the scarcity value for existing miners who possess longer-term production profiles.

Market Update: Probably Still in the Early Innings of a Global Cyclical Recovery

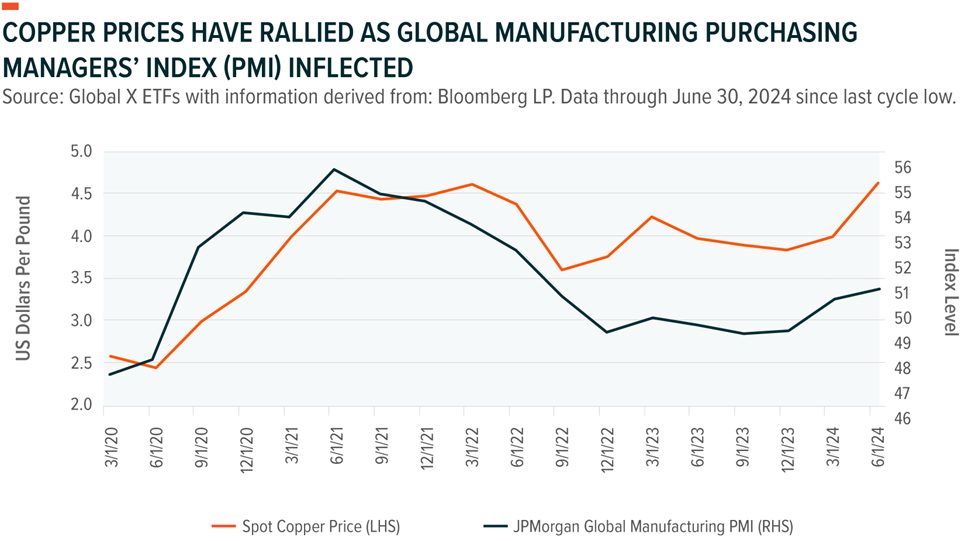

Copper’s longer-term price outlook appears robust, with its growing participation in structural megatrends and the challenging supply outlook not only setting the stage for potentially elevated prices but also likely to set a higher floor for prices throughout the economic cycle. Looking at the market currently, we still see upside potential from cyclical demand moving forward, and we are seeing evidence of this in the data. Specifically, after remaining in contractionary territory for 16 straight months, the JPMorgan Global Purchasing Managers’ Index (PMI) has now been in expansionary territory for six months straight through to June 2024.4 Despite this accelerating trend, global PMI remained well below the previous cycle high of 55.5 seen in the second quarter of 2021, suggesting additional runway for increased copper demand.5 The physical concentrate (the raw material used by copper smelters) market setup is also interesting for miners, with the increase in global smelter capacity putting the market short of concentrate and driving treatment charges to historically low levels.6 We expect this to remain a tailwind for miners, while a rebound in the global industrial cycle could result in increasing refined copper demand. We also believe that the recent copper rally is in its early stages (despite a slight pullback in June), with the global industrial economy likely to continue reaccelerating. Although the spot price of copper hit a record high this year, it was a record in nominal terms only. On an inflation-adjusted basis, the 2024 peak is still more than 25% below the previous cycle’s 2011 peak.7

Conclusion

Overall, we see copper as a potentially attractive opportunity in the commodity markets, where the long-term outlook meets a cyclical opportunity. We view miners as particularly interesting, with the market likely to remain undersupplied on concentrate, while the diverging supply and demand trends could potentially result in increased scarcity value. We also remain optimistic about the short-term outlook, despite the recent pullback in copper prices, believing a cyclical inflection could support prices.

Related ETF

FOOTNOTES

1. Faster Capital. (2024, Jun 11). Economic Indicators: Decoding Dr. Copper’s Prophecy.

2. Ahead of the Heard. (2022, Jul 20). Copper Mines Becoming More Capital-Intensive and Costly to Run.

3. Ibid.

4. Bloomberg LP. Data as of June 30, 2024.

5. Ibid.

6. ING. (2024, Feb 27). The Commodities Feed: Copper TC’s Plunge to Decade Lows.

7. Bureau of Labor Statistics. CPI Inflation Calculator. Data as of June 30, 2024. Historical copper price data are from Bloomberg LP. Data accessed on July 1, 2024

Glossary

JPMorgan Global Purchasing Managers’ Index (PMI): The JPMorgan Global Purchasing Managers’ Index surveys the output and employment intentions of manufacturers to create a measure of economic health. A level above 50 indicates economic expansion and a number below 50 suggests a contracting economy.

DISCLAIMER

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

Published August 23, 2024

Categories: Articles, Insights

Topics: Commodities, Copper